The Internal Revenue Service agents are known for their ability to add it up.

But ‘it’ doesn’t just mean financial numbers—their work also combines resources, evidence, skills and ideas for an optimal result.

To introduce college students to the various fields involved with the federal agency, 10 IRS agents recently came to campus and worked with students in a daylong simulation for a mock criminal fraud investigation. The education and training program, called the Adrian Project, is a nationwide IRS criminal investigation initiative.

UM-Dearborn students—with majors in psychology, cybersecurity and information assurance, journalism and screen studies, criminal justice, accounting and more—participated in the experience.

“We visit different campuses to provide an alternate view of what you could do with the IRS,” said Manny Muriel, special agent in charge at the Detroit IRS. “The IRS doesn’t only focus on tax. We have agents actively involved in national security investigations, corporate fraud investigations and in any type of case that has a financial component. The Adrian Project really sparks an interest because students are able to see ways that they can mesh their different interests—for example, law enforcement and accounting.”

The event—open to all students on campus—was organized by Collegiate Lecturer in Accounting Susan Baker and Beta Alpha Psi, the honor society for students studying accounting, finance or information systems. The project was a College of Business initiative, but the goal was to involve students across campus.

“We wanted to involve majors from other colleges in a collaborative effort where everyone contributes ideas and strategies based on their education and expertise. It’s the best way to see the outcomes of critical thinking,” Baker said. “Employers, like the IRS, know it takes all kinds to make an effective team.”

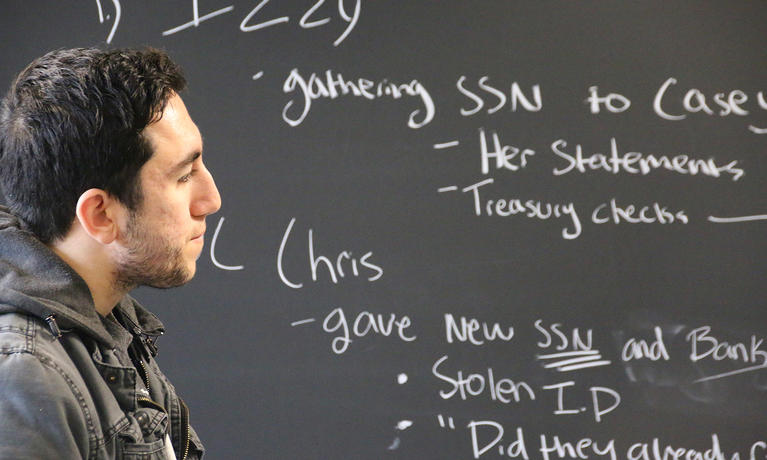

Working in teams, students pieced together clues from a simulated treasury checks fraud case. They led interviews, conducted surveillance, examined tax returns and financial records, and talked about next steps.

“Don’t we have enough evidence for probable cause?” asked JASS junior Leslie King, who is minoring in criminal justice. “If so, we should request a search warrant.”

“Bingo,” said Special Agent David Topolewski, who facilitated one of the groups. Students then were prepped on how to present a case to a magistrate. After making a case to the magistrate and receiving the warrant, they participated in a simulation home search and arrest.

Watching students interact with IRS agents, COB Dean Raju Balakrishnan said he wasn’t surprised that so many students gave up a Friday to take part in the six-hour experience.

“This is about our students having an experiential learning opportunity, which is a key aspect of the UM-Dearborn experience,” he said. “The IRS agents are on campus to show students what a real case is like and how they would systematically go about the case-solving process. Our students recognized this as a fun, interactive way to meet experts in the field and learn from them.”

Beta Alpha Psi Vice President Emily Wolney helped Baker organize the day. Wolney said she was pleased COB brought the Adrian Project to campus—she even counted down the days until the event.

“I’m interested in forensic accounting—yes, I watch shows like Criminal Minds—so I knew the Adrian Project would be exciting,” said Wolney, who has an accounting major and criminal justice minor. “But it was more than that. It opened our minds about the possibilities out there for us. I was able to learn how things worked in a case—beginning, end, everything in between. And it must be a good fit for me because I still want to learn more.”